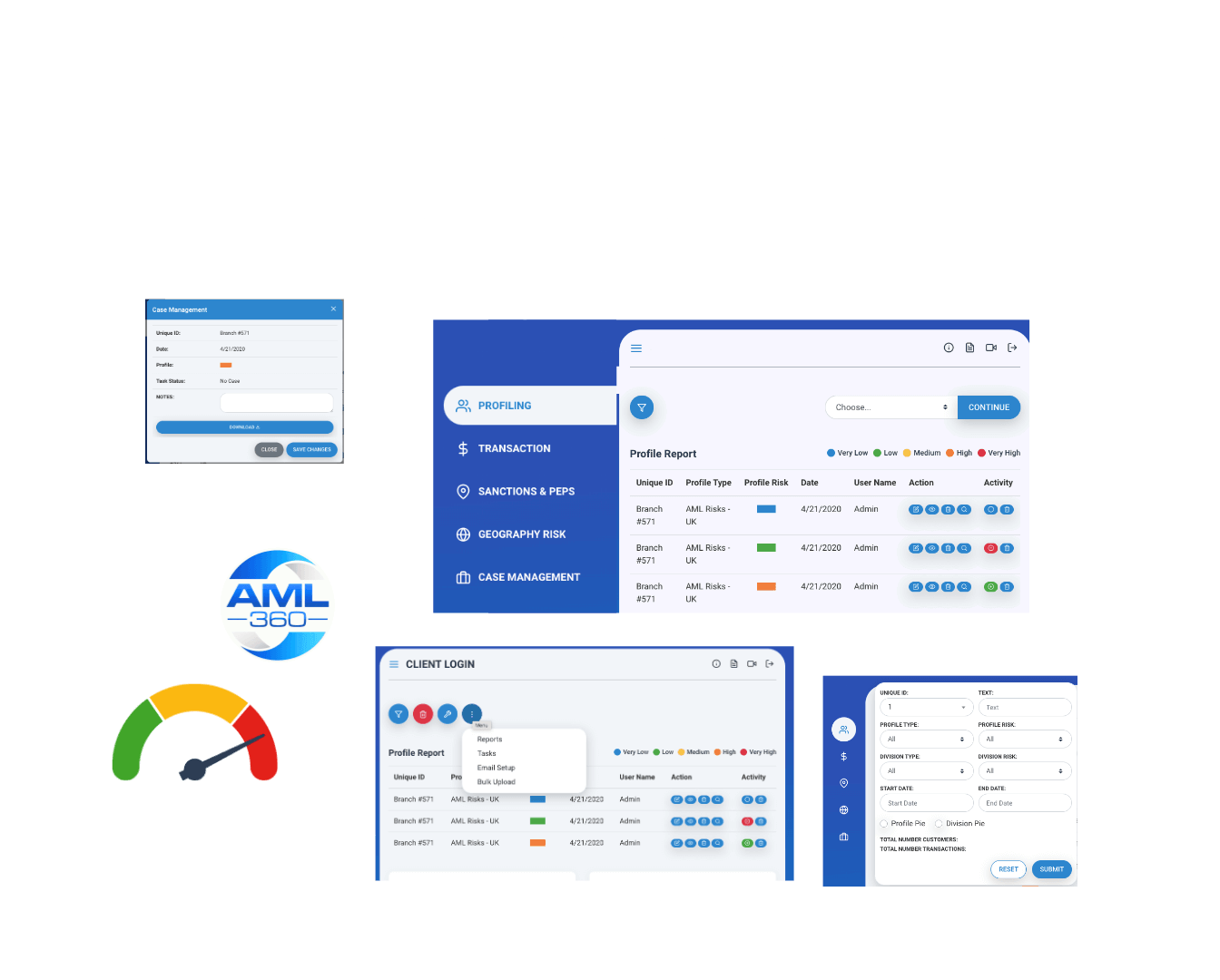

AML Regulatory Technology

Professional Compliance Framework with AML Software

Business owners and compliance professionals can plug into one platform and instantly power up with AML360’s AML Software. AML360 provides a digital anti-money laundering compliance framework. Activate compliance modules and step through automated workflows designed for regulatory effectiveness. The platform ensures businesses use relevant data for identifying, measuring, monitoring and reporting AML/CFT compliance risks.