Asia-Pacific AML (apaml.com)

#amlrisks #riskmanagement #amlcompliance #amlcft #bsarisks

The increasing prevalence of organised trans-national crime across the globe is resulting in an alarming rate of drug overdoses. A drug overdose is the leading cause of accidental death in the United States with Fentanyl (a synthetic opioid), being the most common to cause an overdose death.

Fentanyl is 50 times more potent than heroin and 100 times more potent than morphine. Organised criminals are lacing their narcotics with fentanyl and other deadly synthetic poisons. Unaware of these poisons, young adolescents are purchasing their supplies from online web sites or off the street.

Among youth and young adults aged 15 to 24 years, the average annual overdose death rate was 12.6 out of every 100,000.

To empower governments to prevent such harms, the international financial services industry is obligated to laws known as Anti-Money Laundering and Countering Financing of Terrorism(AML/CFT).

AML/CFT Laws are about Governance, Risk and Compliance Protocols

Distribution of illegal narcotics is only one of the crimes that governments seek to detect and prevent. Other serious crimes connected to trans-national organised groups include human trafficking, child exploitation, serious fraud, theft of personal data, corruption, bribery and tax evasion.

To reduce these national harms, AML/CFT laws obligate participants in the financial services industry to operate with policies, procedures, and controls to detect unusual or suspicious client activity. Unusual or suspicious client activity suspected of being linked to money laundering (ML) or financing of terrorism (FT) must be reported to the jurisdiction’s relevant law-enforcement agency.

AML/CFT International Standards

In working towards world-wide collaboration for stamping out harms from organised criminals groups, international standards of AML/CFT laws are set by the Financial Action Task Force (the FATF).

FATF Recommendations encourage governments to adopt such standards to their AML/CFT laws. Government agencies responsible for oversight of AML/CFT laws are commonly referred to asAML/CFT Supervisors.

If a business is subject to an onsite inspection by an AML/CFT Supervisor, the business should be prepared to have their AML/CFT compliance framework tested for reliability. Should the AML/CFT compliance testing reveal weaknesses, regulatory risk increases.

AML/CFT Business Risk Assessments are the First Step to Compliance

The first step for a firm developing an AML/CFT compliance framework is to conduct an AML/CFT firm-wide risk assessment. Also known as a BSA risk assessment or ‘money laundering risk assessment’, the methodology applied must be reliable. This means the outcomes of the risk analysis must reasonably identify the inherent risks that the business is exposed to in unwittingly facilitating money laundering or terrorism financing.

Identifying Key Risk Indicators

The FATF has identified certain areas within businesses increase vulnerability to ML/FT. Key areas of business operations exposed to ML/FT risks include:

· The nature, size and complexity of the business.

· The types of customers that the business attracts (B2B and B2C).

· The types of products and services distributed by the business.

· The method of how products and services are distributed.

· The geographies linked to customers, transactions and business services.

For these reasons, risk-based AML/CFT laws require business owners, executives and managers to apply risk management procedures and document their ML/FT risks.

Once ML/FT risks are known, the business can then continue with developing an AML/CFT compliance framework by introducing policies, procedures and controls.

Developing Policies, Procedures and Controls

Policies, procedures and controls are required to demonstrate how the business will effectively manage its ML/FT risks. Once developed and implemented, maintenance of the AML/CFT compliance framework is not a one-off exercise but an ongoing obligation throughout the life of the business.

An AML/CFT compliance framework performs by continuously identifying, measuring, monitoring and reporting on ML/FT compliance risks.

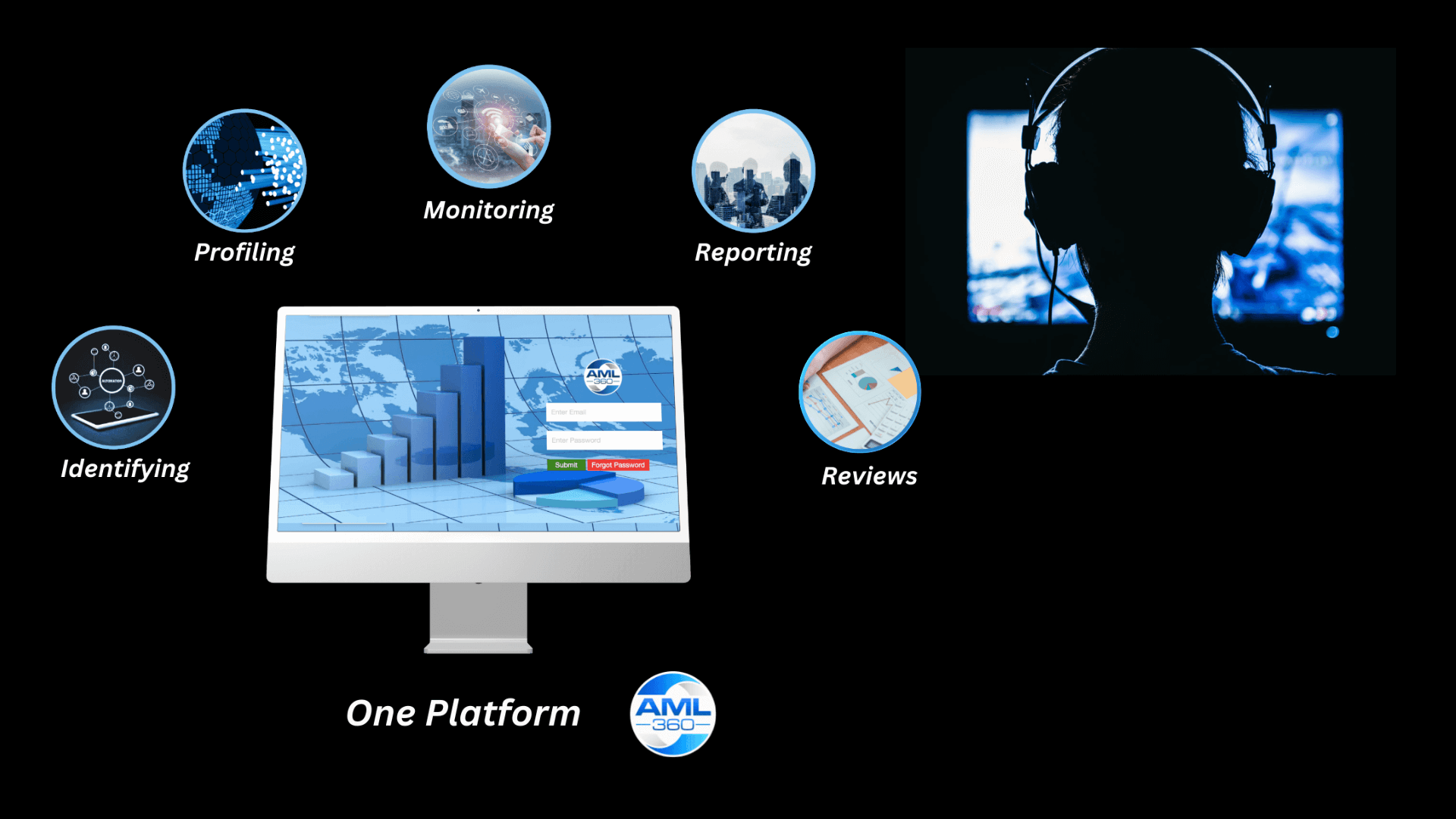

AML360 – A Regulatory Risk-Based Model

The ability to demonstrate a reliable methodology for measuring ML/FT risk is key to achieving regulatory expectations. Should the risk methodology be flawed and have weaknesses, so too will the resulting policies, procedures and controls.

AML360 technology automates internationally accepted practices of measuring risks by using an evidence-based model as set out in ISO 3100:2018.

In following the principles of ISO 3100:2018, and incorporating qualitative AML/CFT data obtained from FATF recommendations, the technology then structures customised corporate data to provide attractive risk reports, inclusive of heat maps and data tables for informed decisionmaking.

Reducing AML/CFT Compliance Costs

Not only does AML360 provide your business with compliance effectiveness, AML360’s proprietary technology eliminates labour intensive processes.

By eliminating labour intensive processes, businesses will significantly reduce their compliance costs.

About AML360

For over 10-years, AML360 has been providing AML/CFT tech-compliance services to businesses that think smarter. Not only does AML360 provide a reliable AML/CFT Regulatory Model, the regulatory technology removes labour-intensive processes and automates complex workflows.

By relying on AML360’s structured AML/CFT compliance framework, Board members, executives and management teams can demonstrate quality governance processes.

What to know more?

AML360 technology fills the void for businesses who operate without an adequate AML/CFT compliance framework.

We provide solutions to ensure monitoring and reporting of compliance functions are streamlined and business costs are reduced.

Our consultants are available to demonstrate additional features and benefits in your business adopting AML360 technology as its trusted compliance partner.